SELF-ASSESSMENT

Synopsis: 890,000 people incur a self-assessment late filing penalty of £100 each.

HMRC has issued 890,000 people with a £100 penalty fine for failing to complete their tax returns by the 31 January deadline. This represents a 20% increase from 2014, where £71m in late returns penalties were issued.

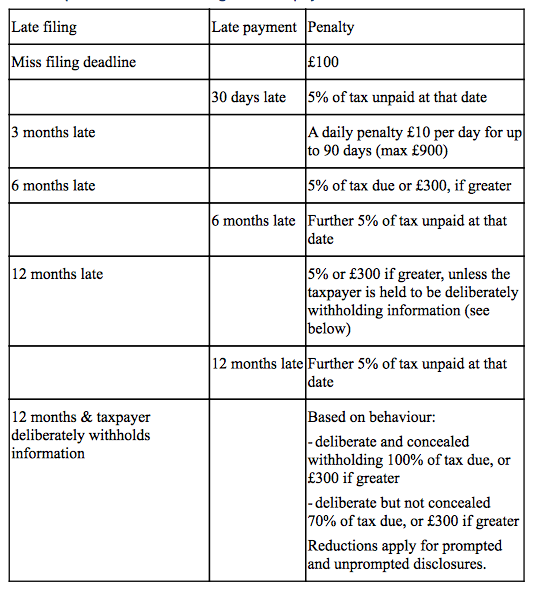

Self-assessment returns which are filed a day late incur a penalty of £100 – regardless of whether there is any tax to pay. What’s more, further penalties are levied the later the return is filed and the later the tax is paid. As a reminder, the current penalties for late filing and late payment are as follows:

COMMENT:

Last month the press reported that HMRC was considering withdrawing the late filing penalty – whether or not this will happen is yet to be seen.

In the meantime, it is evident that HMRC is working on making the process less onerous and has confirmed its intention to start automatically pulling in limited details to individuals’ tax returns from late summer 2015 as part of its drive towards greater automation of services –this should encourage more taxpayers to file on time.

Why not talk to the professionals about properly managing your finances

Call us on 01273 457100020 7871 538701403 333666

Or email us on info@opusgold.com

Or just take a look at how we help our clients www.opusgold.com