AN IMPORTANT INTEREST RATE RISE

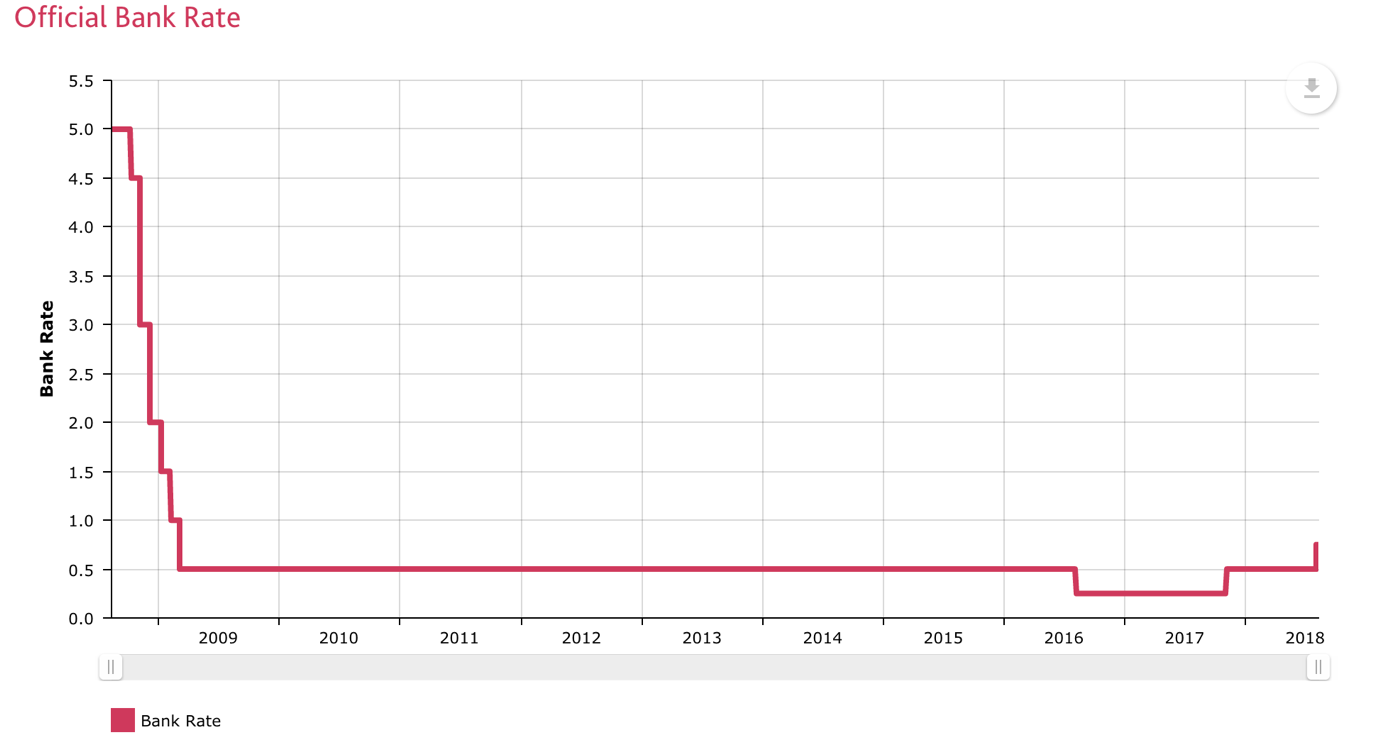

In August the Bank of England raised its main interest rate by 0.25%, taking base rate to its highest level since March 2009. As the Bank’s own graph below shows, there is a long way to go until we return to the rates of ten years ago. To quote the Bank’s Governor, Mark Carney, from here, “rate rises are expected to be limited and gradual”. That translates into perhaps two more 0.25% increases over the next 18 months.

R* arrives and why it matters

When the Bank revealed its rate move, it also published an estimate of what it thought the long-term trend base rate would be to maintain stable economic conditions. This measure, branded R* by economists, was set at 2%-3%, assuming an inflation rate of 2%. The Bank acknowledged that this was a significant downward change in what it had assumed (but not published) in the past. For example, it estimates that in 1990 R* would have been 4.25%-5.25%, based on the same 2% inflation assumption.

That may sound like just more economic jargon, but it has important ramifications for your capital. If the Bank’s thesis is correct – and the signs are that it is – then short- term interest rates may never recover to the levels seen before 2009. The corollary is that returns from cash you hold on deposit will continue to be beaten by, or at best just about match, inflation, even before tax is considered.

Insult to injury…

To make matters worse, the banks and other deposit-taking institutions have not passed on the full 0.25% increase to their savers, although borrowers have not been so neglected. The name of the game is to widen margins, something which has often happened in the past when base rate has changed.

It is not just the High Street banks being mean: at the time of writing National Savings & Investments was scheduled to cut the rate on its Direct ISA by 0.25% from 24 September, a change announced a few weeks before the Bank’s rate move. However, it is increasing rates by up to 0.15% from 1 October on some of its variable rate products.

If you were hoping that the second base rate increase within a year would herald a return to more attractive savings rates, you are probably sadly mistaken. The economic facts of life suggest that interest rates will remain low, even if they nudge up slowly towards the inflation rate. Nevertheless, if you are searching for income, there are plenty of opportunities available to beat today’s deposit rates. For instance, in mid- August UK shares were, on average, offering a dividend yield of around 3.7%.

ANOTHER BUDGET

Back in November 2016, the then relatively new Chancellor announced an end to Spring Budgets after the one due in March 2017. A new cycle is now in place, with March 2018 having seen Mr Hammond present a relatively brief Spring Statement. Whereas his predecessors had often turned the Autumn Statement into a second unofficial Budget, Mr Hammond is aiming for major tax changes to be announced only once every 12 months, well ahead of the start of the tax year.

So what can we expect…?

The ‘knowns’…

To give the financial services community some light holiday reading, in July the Treasury published Finance Bill 2019 draft clauses for consultation. These contained nothing of any great surprise but, subject to any late amendments, confirmed the following changes:

Rent-a-room relief – This relief currently exempts up to £7,500 of rental income from tax if you let out part or all of your home. From 2019/20, the relief will not be available if neither you nor any member of your household occupy the property during at least part of the rental period. Thus, if you go on a world cruise and rent out your empty home while you are away, no rent-a-room relief will be available. Residents of Wimbledon who vacate for two weeks of profitable renting each year, take note…

Capital gains tax on residential property

This is yet another piece of legislation aimed at the buy-to-let investor – or perhaps that should be disinvestor. From 2020/21, for UK residents the payment date for capital gains tax (CGT) on residential property profits will change to within 30 days of the sale date.

At present CGT is due on 31 January in the tax year following the tax year of the transaction, meaning a sale at the start of the tax year can delay tax payment for nearly 22 months. One strange side effect is that if you sell a property in 2019/20, your CGT bill will be due later than someone selling before 31 December 2020, in the following tax year. The change could make next tax year a busy one for sales of existing buy-to-let property as ‘amateur’ landlords quit the market.

Stamp Duty Land Tax payment

From 1 March 2019 returns and payments for Stamp Duty Land Tax (SDLT, covering England and Northern Ireland) will have to be made within 14 days of the property transaction rather than the current 30 days.

Offshore time limits

In another turn of the tax collection screw, for income tax, CGT and inheritance tax, the assessment time limit for non-deliberate offshore compliance failures will be extended to 12 years from the current 4 years or 6 years, depending upon the nature of the error. The reform will effectively be retrospective, e.g. for income tax and CGT errors resulting from carelessness, the first tax year affected will be 2013/14. For deliberate errors, the assessment time limit remains at 20 years.

This change comes after the end of HMRC’s “Requirement to Correct” (RTC) initiative for undeclared offshore tax liabilities, the deadline for which is 30 September 2018. RTC will be followed by a new tougher Failure to Correct (FTC) system, with a penalty starting point of 200% of the tax liability.

The ‘known unknowns’

The Budget will provide details of the new income tax bands and allowances for 2019/20. There are three points to watch here:

- The last Conservative manifesto set a target for a personal allowance of £12,500 and a higher rate threshold (ex-Scotland) of £50,000 for 2020/21. At present these are £11,850 and £46,350, implying the Chancellor will need to give the higher rate threshold a bigger upward nudge than the personal allowance.

- You could find that the benefits of increases to the personal allowance and higher rate threshold are more than countered by additional pension contributions from April 2019 if you are in an auto-enrolment pension scheme. For many employees, their personal contributions will rise by about two thirds, while employers will see a 50% increase.

However, if you are self-employed, you are outside the scope of pension auto-enrolment and instead you will gain both from any income tax changes and the ending in April 2019 of Class 2 National Insurance contributions (currently £2.95 a week).

- The £150,000 threshold for additional rate tax will reach its ten-year anniversary in 2019, having been set at that level in the 2009 Budget by the last Labour Chancellor, Alastair Darling. A decade on the threshold is long overdue an update. Had it been (CPI) inflation proofed since 2010, it would be around £185,000 in the coming tax year. The same 10-year freeze has applied to the £100,000 threshold at which the personal allowance begins to be phased out. Inflation would bring that threshold to about £125,000 for 2019/20. Alas, in neither instance is there much incentive for the Chancellor to make any adjustment.

The ‘unknowns’

Although Mr Hammond’s move to an Autumn Budget is meant to reinforce a consultative approach to tax legislation, it does not mean Budget surprises have become a thing of the past. Major reforms to the tax framework are still likely to require some changes to take immediate effect, if only to prevent taxpayers adopting forestalling measures. The detail can then be put in place on the normal legislative cycle. There are two areas where such a scenario could play out:

Inheritance tax

In January of this year, the Chancellor asked the Office of Tax Simplification (OTS) to review inheritance tax (IHT). He wanted the OTS “to ensure that the system is fit for purpose” and to look at “whether the current framework causes any distortions to taxpayers’ decisions surrounding transfers, investments and other relevant transactions”. As the basic structure and much of the legislation for IHT dates back to 1984, there is almost certainly scope for the OTS to propose some changes.

Mr Hammond’s reference to “distortions to taxpayers’ decisions” could point to changes being made on the business relief front. At present shareholdings which qualify for business relief are generally exempt from IHT after two years of ownership, with spouses and civil partners able to link ownership periods for transfers between them made on death. In recent years there has been a growth in the use of “IHT portfolios” built around AIM and unlisted shares which qualify for business relief. It is arguable that distortions are emerging here.

For example, some of the largest AIM companies (worth £1bn+) which would be more suited to the main stock market than its junior counterpart, do not make the move because of the importance of retaining eligibility for business relief. Without that eligibility, their share values could fall. Were the Chancellor to decide to revamp business relief, he would almost certainly take immediate ‘anti-forestalling” action rather than risk creating a buy-now-while-stocks-last period until next year’s Finance Act becomes law.

A similar instant cut-off could occur were there revisions made to the lifetime gift rules, which are highly generous, if you have the available funds:

- Currently outright capital gifts escape IHT, regardless of their size, if you survive seven years after making them (and may benefit from reduced tax after just three years).

- Under today’s “normal expenditure” rules, regular gifts out of income are immediately IHT-free, provided they do not reduce your standard of living.

Pensions

It is rare for the time shortly before a Budget or statement from a Chancellor for there to be no rumours about a cut to the tax reliefs for pensions. The current decade has seen cuts to both the annual allowance (limiting tax-efficient contributions) and the lifetime allowance (limiting the size of tax-efficient accumulated funds). However, the elephant in the room – the rate of tax relief on contributions – has been ignored. In July The Times reported that the Treasury was investigating the introduction of a 25% flat rate of relief. This would mean that if you are a basic rate taxpayer you would receive an extra 5% tax relief – a £100 contribution would only cost you £75.

However, if you pay tax at more than basic rate, you would be worse off because the net cost of your contribution would rise from the current £60 for higher rate taxpayers (£55 for additional rate taxpayers). The end result would be an extra £4bn for the Exchequer and most pension contributors receiving more tax relief – a tempting combination for any politician.

Further support for a flat rate approach subsequently emerged from the influential House of Commons Treasury Select Committee, which suggested the Government should consider:

- Replacing the lifetime allowance with a lower annual allowance; and

- Introducing a flat rate of relief.

The measures and non-measures outlined above are by no means the full list. However, they should serve as a reminder that the burden of tax is likely to become heavier. The Chancellor has extra money (£20.5bn a year by 2023/24) to find for the NHS following the Prime Minister’s Summer pledge. Even though the latest Government borrowing figures suggest he has some wriggle room, he is not going to be in tax-cutting mode this Autumn.

ISAs: one in, one out?

Next April will mark the 20th anniversary of the introduction of Individual Savings Accounts (ISAs). Back in April 1999, there were only three types of ISA, with a maximum total investment of £7,000 per tax year, of which only £3,000 could be placed in a cash ISA.

The ISA world has changed significantly since then, with an array of different variants launched and the maximum annual investment limit raised to £20,000. What was once a relatively simple savings plan is now anything but – and further complications could be on the way.

Out with the Lifetime ISA…

The Lifetime ISA (LISA) was the last ISA variant to be launched. It was announced in March 2016 by George Osborne, but did not come into existence until April 2017, having undergone a near death experience in the interim when Mr Osborne departed. With hindsight, it might have been better for the LISA not to have survived. It has been anything but a success, with both the financial services industry and investors showing little interest.

In July the Treasury Select Committee (TSC) said that it had received “strong criticism of the Lifetime ISA (LISA) over its complexity, its perverse incentives, its lack of complementarity with the pensions saving landscape and its apparent lack of popularity with the industry and pension savers.” The TSC’s unsurprising conclusion was that the Government should abolish LISAs. It is easy to imagine that Mr Hammond might willingly adopt the advice.

While the TSC’s criticisms are valid, what the LISA offers can be the best savings option for some people under the entry age limit of 40. As ever, what matters are individual circumstances, so a personal assessment is necessary.

…And in with the Care ISA?

The ISA ‘brand’ has been stretched far and wide since 1999, so it is no surprise that rumours have once again emerged of a ‘Care ISA’. The latest reports say a Care ISA could be announced in the Autumn, when the Government publishes its delayed Green Paper on long-term care. It is suggested that this new ISA would be earmarked to finance care costs, but to the extent that any funds remained on death, they would be exempt from inheritance tax.

After the problems Theresa May faced when addressing the issue of social care costs during last year’s election campaign, the Government is going to tread very carefully in this area. The Care ISA idea has already met criticism from within its own ranks – the Conservative head of the House of Commons Health and Social Care Committee has dismissed the rumoured plan as too narrowly targeted.

In the meantime

In terms of collecting savings, ISAs have been a success. The latest HMRC figures, to April 2017, show that there was a total of over £585bn invested in ISAs. However, close to half the amount is held in cash ISAs which generally offer sub-inflation interest rates – often under 1% for older plans. In any case the role of the cash ISA is open to question now because of the introduction of the personal savings allowance in April 2016, which takes up to £1,000 of interest out of tax.

ISAs, like any other form of investment, need to be reviewed regularly. Although the greatest benefits come from long-term investment – there are ISA millionaires – that does not make ISAs lock-up-and-leave products. For example, tax and pension changes in recent years have altered the role of ISAs for some investors.

Past performance is not a reliable guide to the future. The value of investments and the income from them can go down as well as up. The value of tax reliefs depend upon individual circumstances and tax rules may change. The FCA does not regulate tax advice. This newsletter is provided strictly for general consideration only and is based on our understanding of law and HM Revenue & Customs practice as at August 2018. No action must be taken or refrained from based on its contents alone. Accordingly, no responsibility can be assumed for any loss occasioned in connection with the content hereof and any such action or inaction. Professional advice is necessary for every case

If you would like to know more about further financial planning services we can offer please e mail or call us to discuss:

London 020 7871 5387

Brighton 01273 457100

Horsham 01403 333666